Learning Objectives

Download Training Brochure

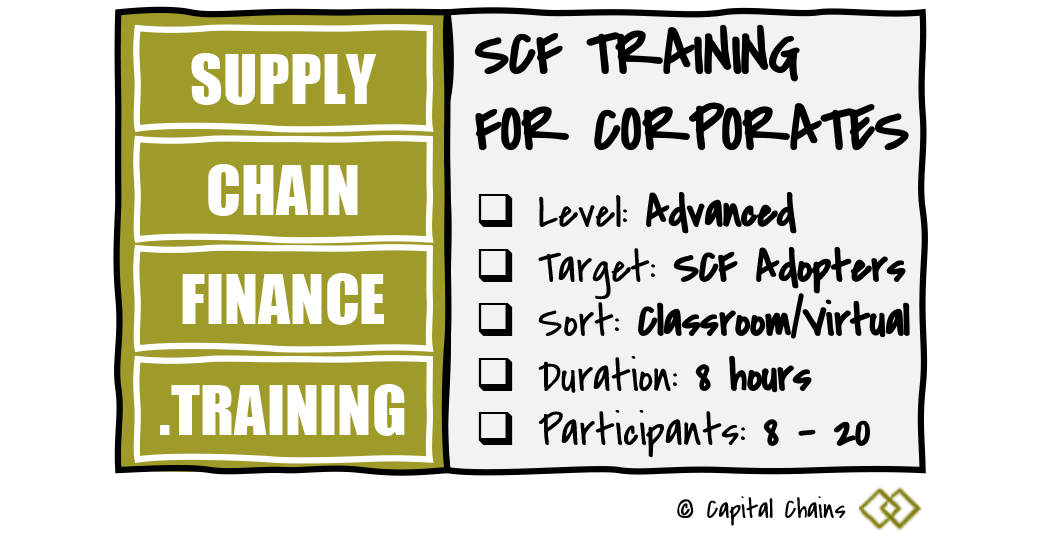

Capital Chains accelerates the provision and adoption of SCF solutions

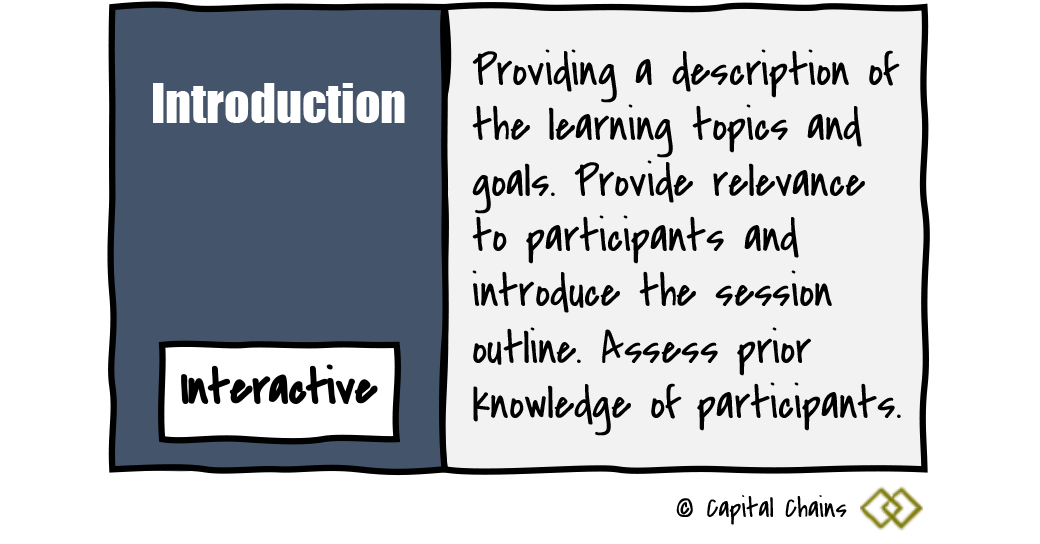

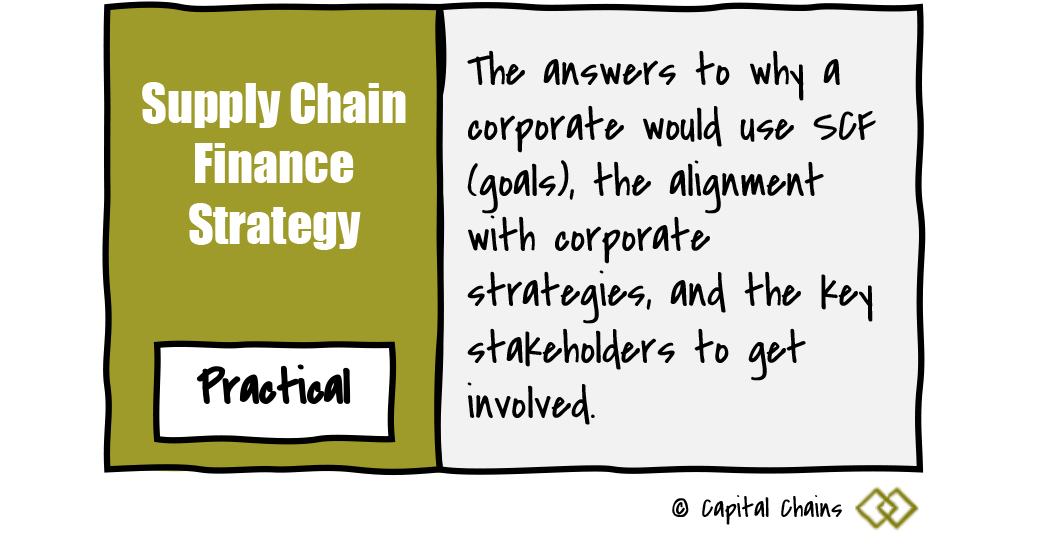

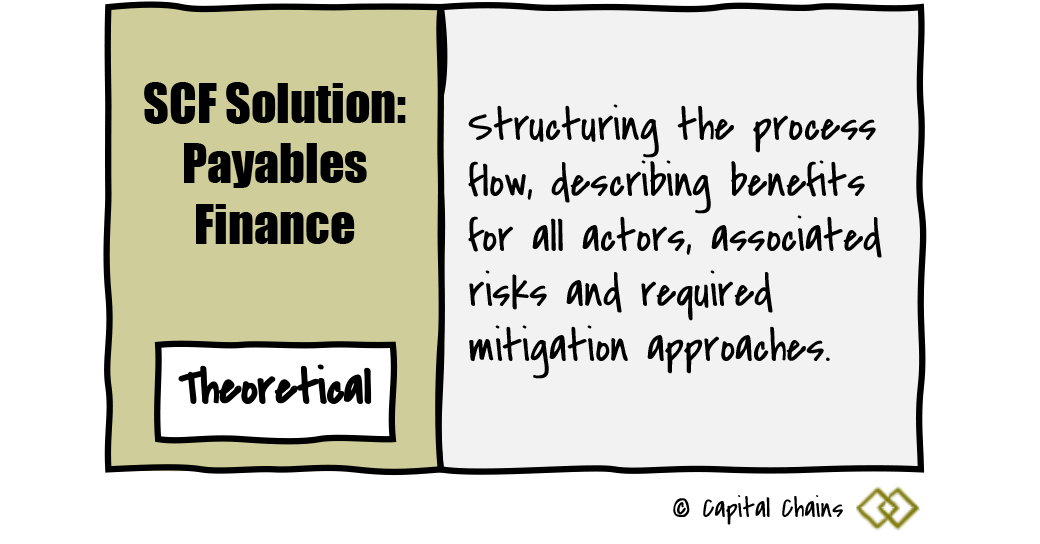

Let us turn theoretical knowledge into practical insights for your learners

Download Training BrochureTraining Outline

Download Training Brochure

Capital Chains accelerates the provision and adoption of SCF solutions

Let us turn theoretical knowledge into practical insights for your learners

Download Training Brochure