Our Expertise

The Supply Chain Finance (SCF) playing field is associated with the various physical, financial, and corresponding information flows and is aimed at achieving the best results for all participants in a supply chain. When formulating an SCF strategy, companies need to ensure that there is alignment with the overall business strategy of a company. The SCF strategy is key in choosing which products or offerings will be used by corporations when planning for an SCF implementation.

There are three main incentives for a Supply Chain Finance strategy:

- Financial Performance: release working capital

- Operational & Delivery Performance: reduce risk / increase responsiveness

- Social Performance: improve relationship / responsibility

Definition of Supply Chain Finance

Supply Chain Finance (SCF) is defined as the use of financing and risk mitigation practices and techniques to optimize the management of the working capital and liquidity invested in supply chain processes and transactions. Visibility of underlying trade flows by the finance provider(s) is a necessary component of such financing arrangements which can be enabled by a technology platform.

A relatively large spectrum of SCF solutions/products are available in the market. Following the definitions of the Global Supply Chain Finance Forum (GSCFF), SCF products can be divided in two categories:

- Receivables purchase: a seller (e.g. a supplier) obtains financing by selling receivables to a finance provider. Payables Finance or Reverse Factoring is the best-known product within this category.

- Loan-based: a seller or a buyer (e.g. a distributor) receives loans and advances against underlying assets. Examples are Purchase Order (PO) Finance and Distributor Finance.

Navigating our expertise

Capital Chains accelerates the provision and adoption of SCF solutions

Benefits of Supply Chain Finance

Why start offering an SCF solution? For SCF adopters the answer depends on your line of reasoning and your intended goal. Common reasons to engage in SCF are related to business growth (need for short-term financing), stabilizing or improving working capital/cash position, Return on Investment (ROI), supply chain efficiencies, strengthening the supply chain and SME finance. For SCF providers, the rationale for an SCF adopter to start offering SCF is key to ultimately sell their solution. However, some benefits and costs account for both SCF adopters and SCF providers.

It is always a matter of comparing direct and indirect benefits with costs:

Navigating our expertise

Capital Chains accelerates the provision and adoption of SCF solutions

Risks of Supply Chain Finance

In most SCF programs, SCF providers will utilise the anchor’s credit worthiness for the benefit of other supply chain partners. Based on the business case made, SCF providers need to assess the level of risk exposure they are willing to take. The higher the risk appetite, the more SCF providers gain access to new parties and markets of up- and down-stream supply chain partners.

SCF providers typically favour SCF solutions over individual financing arrangements as they can benefit from the increased transparency and visibility on the underlying trade flows. Next to that, SCF solutions are uncommitted short-term funding arrangements which reduces the cost of funds for SCF providers and increases the attractiveness of the offer for SCF adopters. Since SCF products are highly technology dependent, the introduction of such products also introduce a new set of types of risks.

Navigating our expertise

Capital Chains accelerates the provision and adoption of SCF solutions

Sustainable Supply Chain Finance

At Capital Chains sustainability has a two-fold meaning when it refers to supply chain finance. First, sustainability refers to sustainable (long-term), trustworthy business relationships between (hopefully, someday ‘all’) supply chain partners. Second, it refers to initiatives to reduce the ecological and environmental footprint of businesses within supply chains.

SCF could play a significant role in achieving sustainability within supply chains. Beside commercial benefits, SCF solutions (when implemented correctly) are known to strengthen buyer-supplier relationships and incentivise supply chain partners to invest in their people and environment. Over time, strong business relationships become increasingly valuable when trust and reliability become more important than the pricing element alone.

As sustainability is gaining ground in global discussions, large corporates are increasingly being incentivised or forced by regulations to adapt to new environmental and ecological standards. These standards are not just applicable to their own company, but also for their extended supply chains. We believe providing SCF solutions at favourable terms, only to supply chain partners who meet certain sustainability standards, will accelerate the adoption of these standards. With that believe in mind, strong and reliable business relationships build on trust and mutual dependency are a perfect starting point for a corporate to make an impact.

Navigating our expertise

Capital Chains accelerates the provision and adoption of SCF solutions

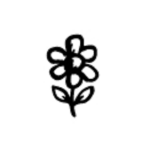

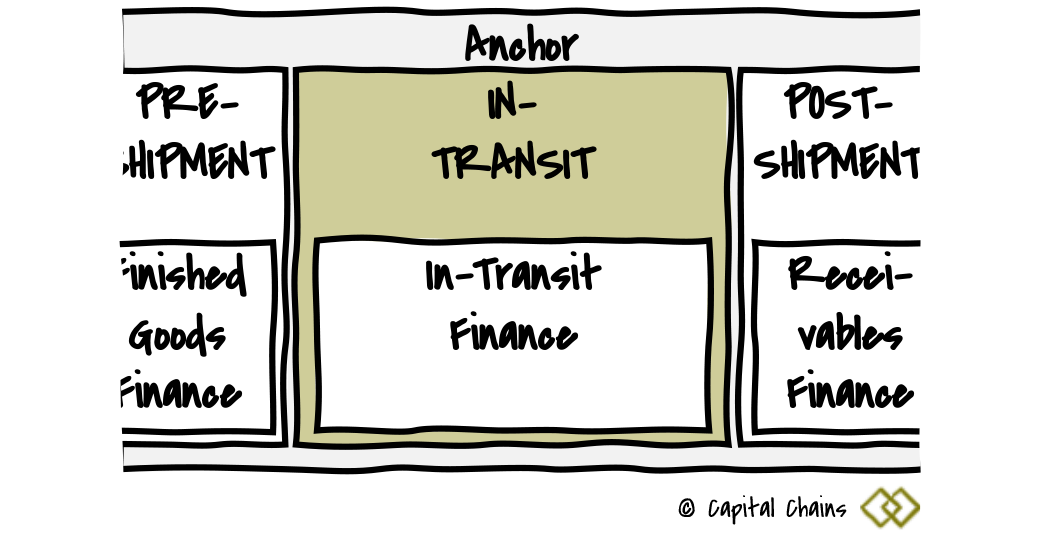

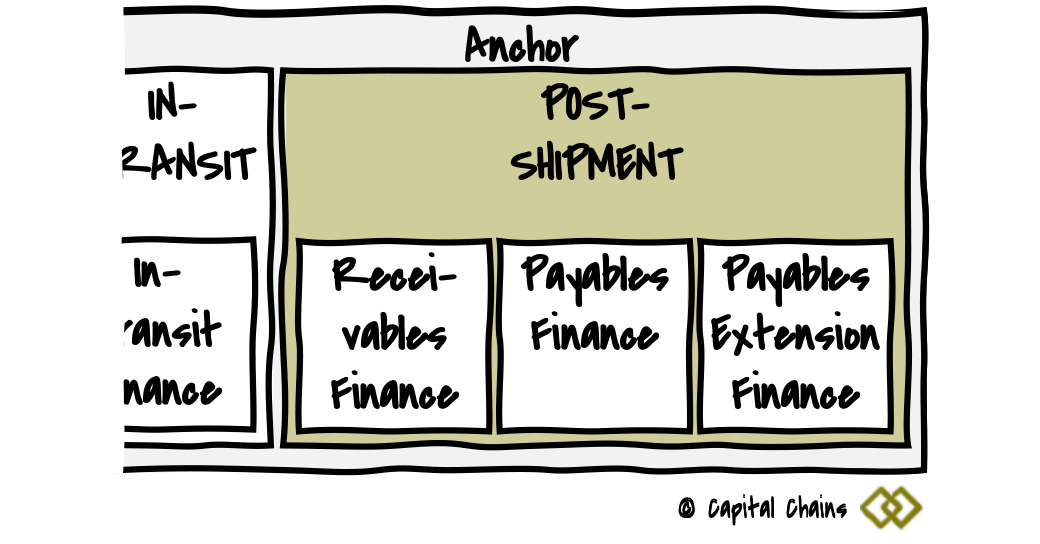

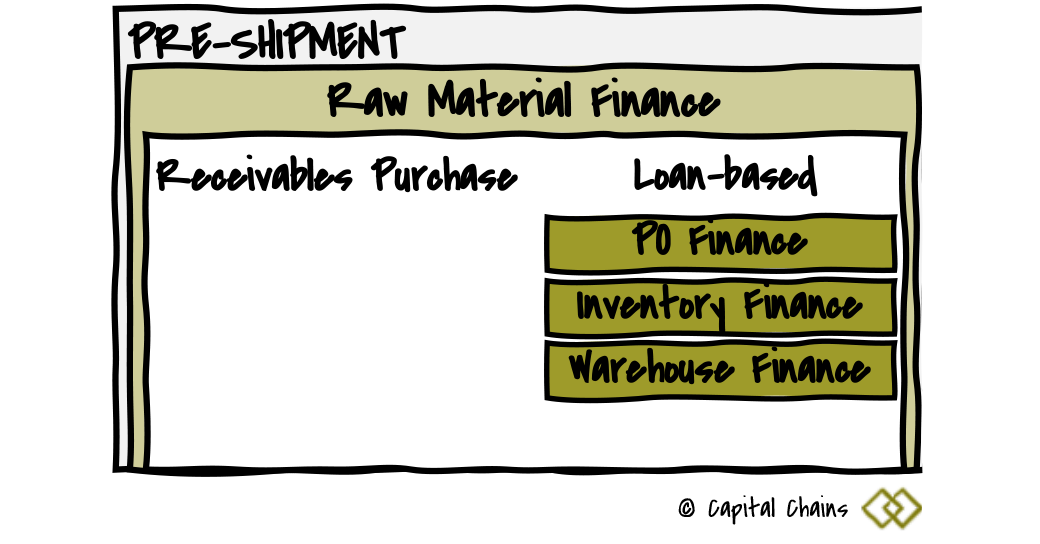

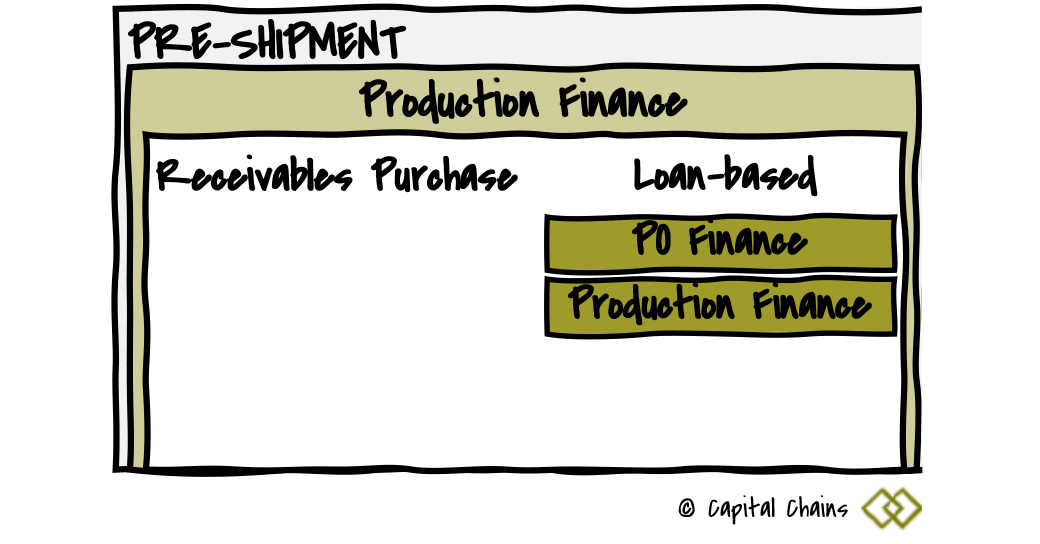

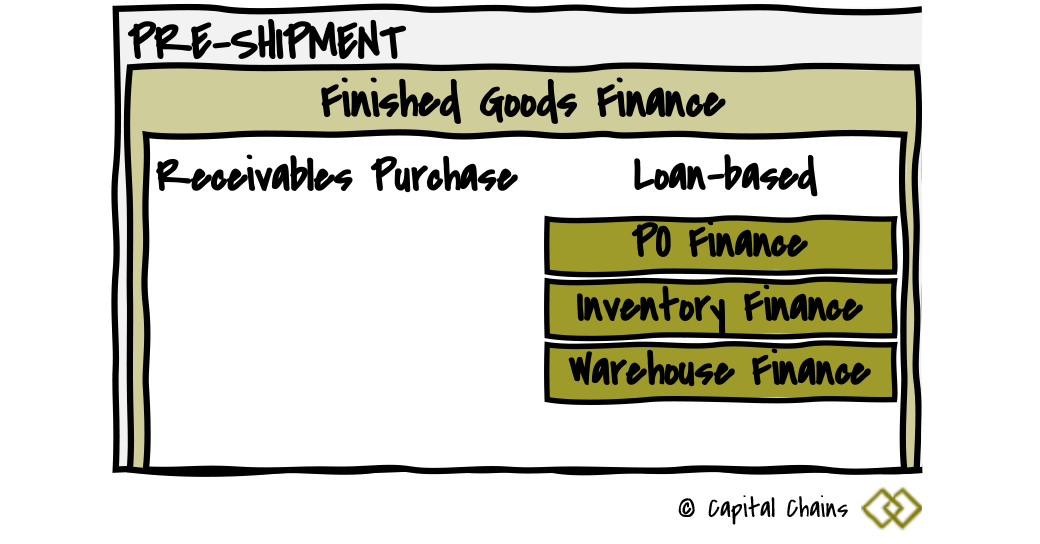

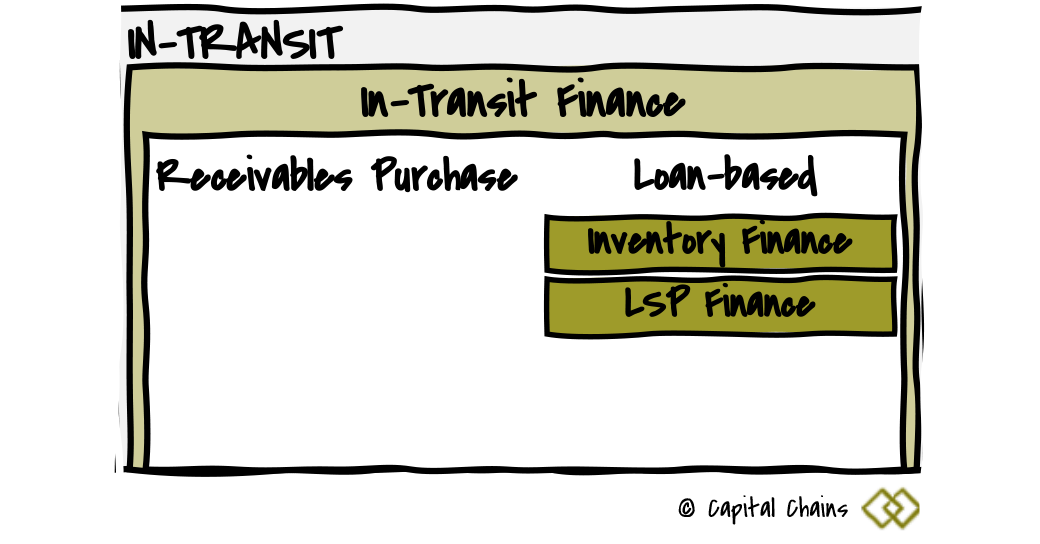

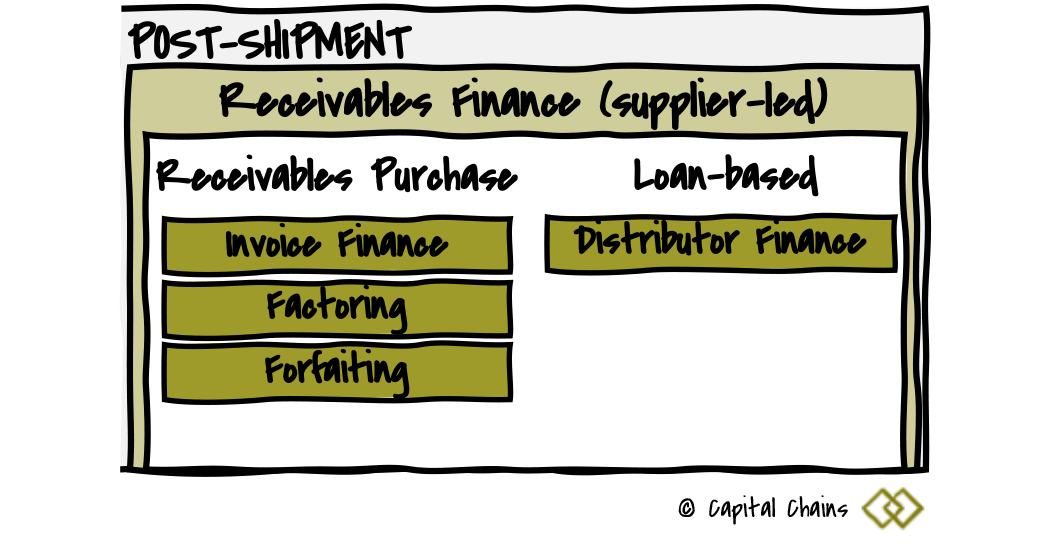

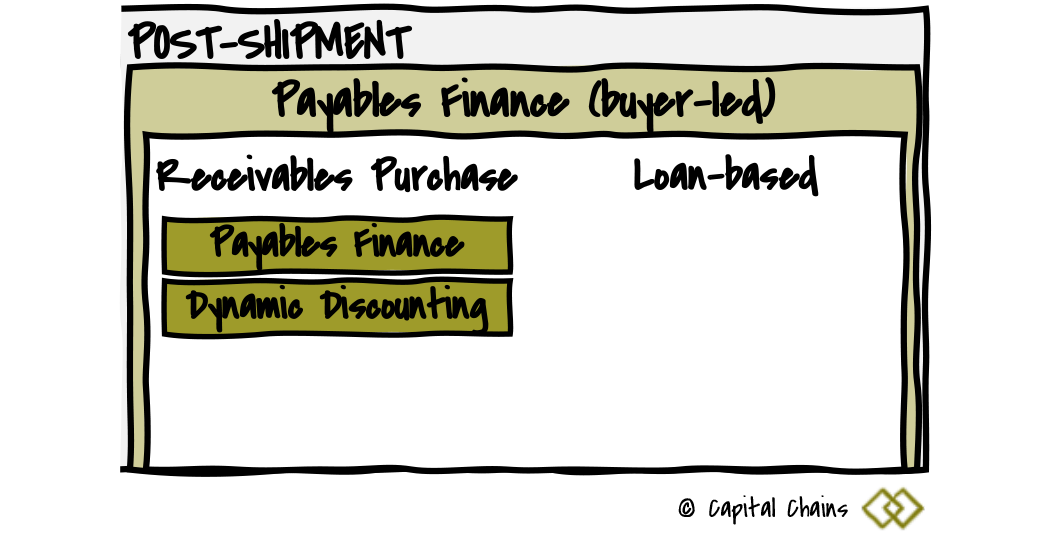

Overview of Supply Chain Finance solutions

Supply Chain Finance covers a wide spectrum of individual solutions, with a concentration on the post-shipment solutions. The products most widely associated with SCF are Payables Finance and Dynamic Discounting, but there a many more solutions that could be utilised in the end-to-end supply chain. Determining which SCF solution fits a specific business opportunity or perspective is dependent on the characteristics of a supply chain and the actors within that supply chain. Capital Chains has developed a service aimed at supporting clients in the mapping of the supply chain and identifying (and quantifying) the SCF opportunities.

For an overview of SCF solutions in the end-to-end supply chain a visualisation is needed that includes both upstream supply chain partners (suppliers), as well as downstream actors (distributors, retailers). For each node in that supply chain, three stages can be identified: pre-shipment, in-transit, and post-shipment. Each of these stages presents its own opportunities for financing and hence different SCF products.

Within each category of SCF products a final segmentation can be made between solutions that are based on receivables purchase or should be categorised as loan based.